Vea también

05.02.2026 04:10 PM

05.02.2026 04:10 PMIf Donald Trump didn't exist, someone would have to invent him. Even during his first presidency, there were whispers that he was a free?trader at heart — that tariffs were just a tool to get other countries to lower theirs. The second term showed a different reality. Draconian US import duties are forcing countries to diversify exports and seek free?trade agreements.

Europe has been especially active in this area. EU negotiations with Latin America, Indonesia, India, and most recently Australia deserve attention. The EU is revising supply chains and thawing a trade agreement with the US that had been paused amid tariff threats related to Greenland.

Because of White House policy, Forex traders hardly get any peace. The FX market alternates between a calm regime — where pricing is driven by macro data and central?bank policy — and explosive episodes triggered by various shocks. Think Venezuela, Iran and Greenland!

Volatility dynamics in currency market

President Trump's comment that he supports a weaker dollar, coupled with rumors of coordinated currency intervention, struck another blow to investor nerves. Forex volatility jumped to the highest levels since the April tariffs on Liberation Day; the euro reached its strongest level against the greenback since 2021, and the Swiss franc since 2015.

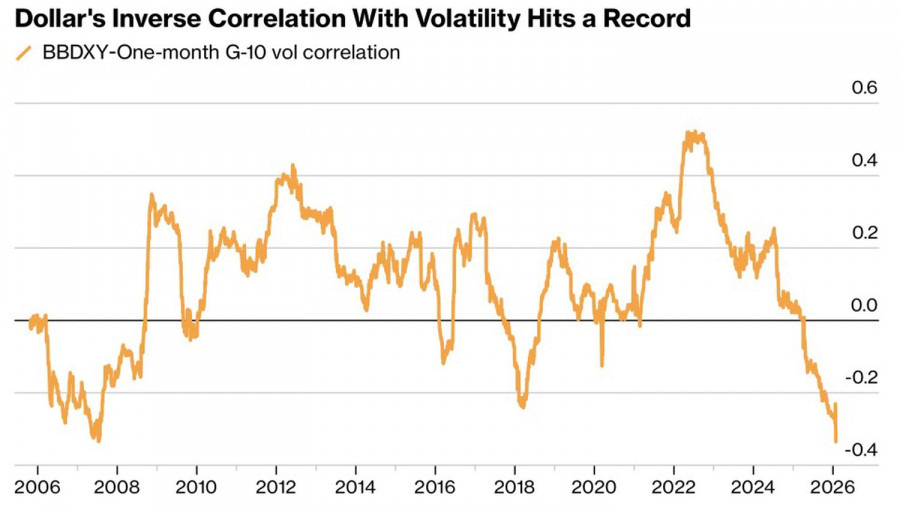

Spikes in quote variability are negative for the US currency because confidence in the dollar falls amid White House policy uncertainty. Conversely, when the storm subsides the dollar begins to regain lost trust and strengthens. As a result, the correlation between the USD index and volatility has reached its most negative reading on record.

Correlation dynamics between FX volatility and the US dollar

Donald Trump won't stay young forever and won't keep misbehaving indefinitely. So the asymmetry observed during the first year of his second term will most likely persist. That gives traders a template to improve efficiency when trading dollar pairs on Forex.

Support for the greenback is also coming from a rise in the US economic surprises index to its highest level since late 2023. Actual US economic data have consistently beaten Bloomberg forecasts lately, which is bullish for the dollar. That cannot continue forever — analysts will eventually raise their estimates, making outperformance harder to achieve.

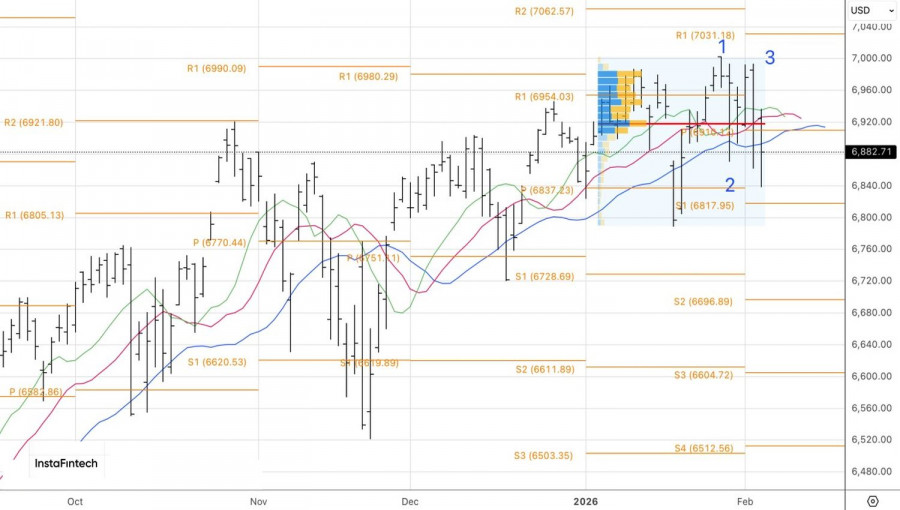

Technically, the daily chart for EUR/USD shows consolidation after a heavy sell-off. A drop below the lower cluster boundary at 1.1775 would be a sell signal. Consider returning to longs only above 1.1835.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.