Veja também

04.02.2026 10:43 AM

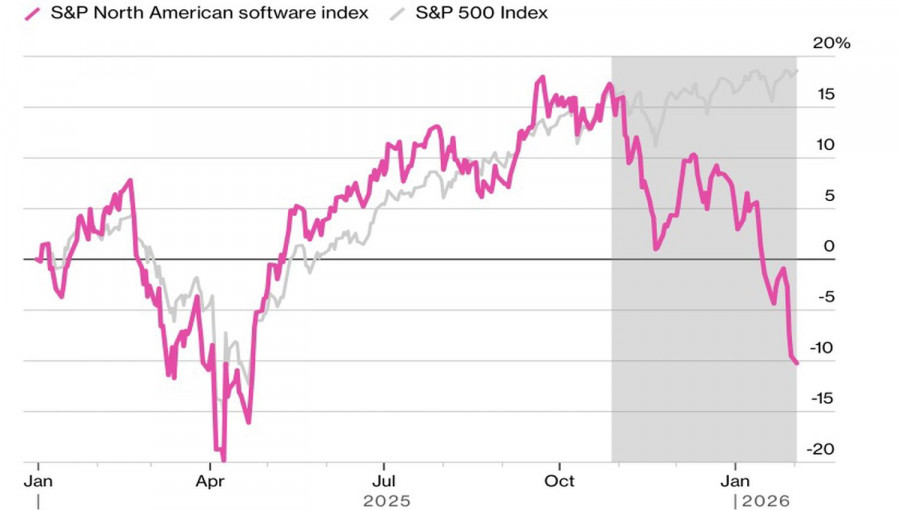

04.02.2026 10:43 AMWhat does not kill us makes us stronger. What stops helping, sooner or later destroys. Fears that financial firms and software vendors will be undermined by new AI developments have hammered S&P 500 quotes. New products from Anthropic can write programs and perform a range of legal and financial tasks. Rather than helping the broad index, this news has put pressure on it.

Dynamics of S&P 500 and software makers basket

Over the past three to four years, AI has become a hallmark of both the US economy and its financial markets. American exceptionalism boosted GDP growth, strengthened the dollar, and produced numerous S&P 500 records. Gradually, however, AI began to displace workers, prompting the Fed to ease preemptively. Now many companies face threat: why pay huge sums for software development if AI can do it?

The Anthropic headlines accelerated the tech sell?off, but the rotation began earlier. At the turn of 2025-2026, a broad market rotation was already underway. Strong US data encouraged investors to diversify into small-cap stocks. Earnings season sent some money back to the big tech names, but innovations have reset the cycle.

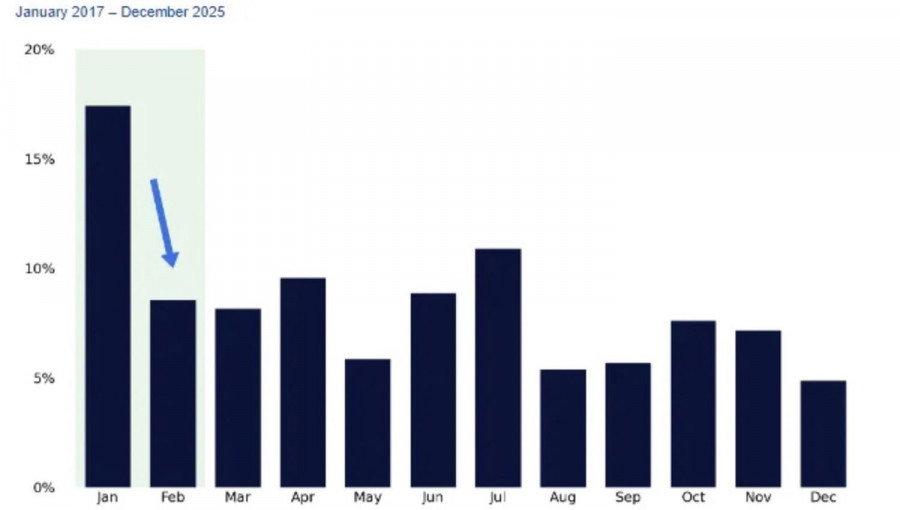

The situation is compounded by slowing liquidity flows in February and the months ahead. In January, they exceeded the same period in 2025 by 50%. Seasonality now creates problems for the S&P 500, especially with Kevin Warsh on the verge of becoming the new Fed chair and planning to fight inflation by shrinking the Fed's balance sheet. This is bad news for liquidity and risk assets.

Dynamics of liquidity flows into US equity market

Dovish FOMC comments did not help the S&P 500. Stephen Miran said the federal funds rate should fall by more than 100 basis points because, in his view, there is no real high inflation in the United States — it's all quirks of faulty measurement. Richmond Fed President Tom Barkin believes that current policy is still restrictive, implying he would support a resumption of easing.

Accordingly, tectonic shifts are taking place in the US equity market. It started with rotation from tech into small caps. Now investors are actively dumping stocks of issuers that AI will render obsolete.

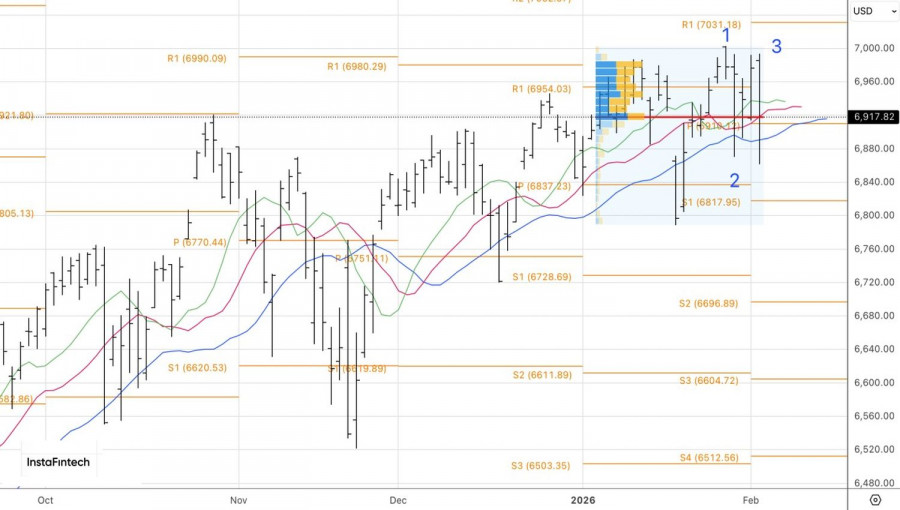

Technically, on the daily chart, the S&P 500 showed an engulfing of the prior bar, completing the formation of a 1?2?3 reversal pattern. A drop below fair value at 6,820 followed by a hold there would be a signal to sell the broad index.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.