یہ بھی دیکھیں

21.01.2026 10:05 AM

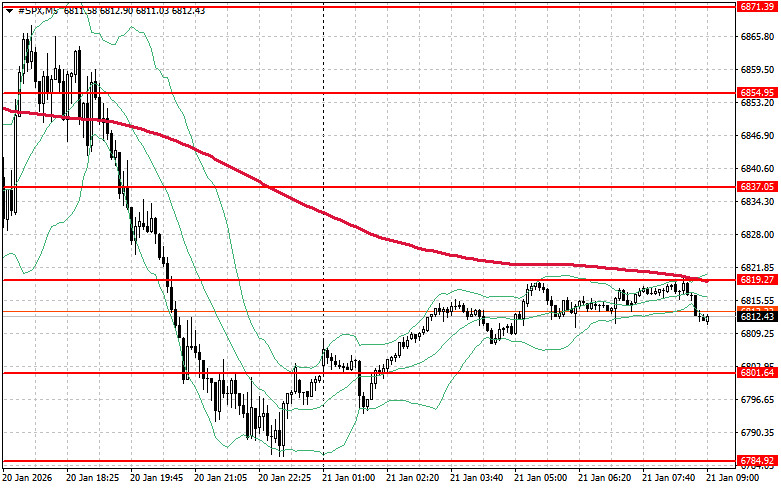

21.01.2026 10:05 AMYesterday, stock indices closed with sharp declines. The S&P 500 fell by 2.06%, while the Nasdaq 100 dropped by 2.39%. The Dow Jones Industrial Average lost 1.76%.

Japanese bonds recovered after the sell?off that hit global debt markets, as did futures on US equity indices, as volatility showed signs of easing. The yield on 40?year Japanese bonds fell by 22 basis points to 3.99% after Finance Minister Satsuki Katayama called for calm following the rout that pushed ultra?long yields to historic highs. As another sign that markets are beginning to stabilize, Treasuries firmed slightly and S&P 500 futures rose by 0.3% after the underlying index posted its sharpest one?day drop since October last year.

European equity markets also remained unstable, while Asian markets slid by 0.6%, extending a three?day slide. Demand for safe?haven assets persisted: gold and platinum hit new record highs, and silver approached its historical peak.

Today, traders will watch closely President Donald Trump's scheduled trip to the World Economic Forum in Davos after he escalated tensions with Europe. The president said he would likely "sort something out" on the Greenland issue. Trump's threat to impose tariffs on European countries that rejected his offer to buy Greenland destabilised markets and forced investors to reassess risks.

If Trump fails to patch things up, such impulsive decisions and statements, especially on trade policy and alliances, could have long?term negative consequences for the global economy. Trump's unpredictability creates an atmosphere of uncertainty that deters investors and complicates long?term planning for businesses. In Davos, Trump is due to meet with European leaders and try to smooth differences. However, given his previous remarks and negotiating style, it is unclear whether he can achieve meaningful progress. Markets will be watching for any signals that Trump is softening his stance or, conversely, further escalating the conflict.

As for technical outlook for the S&P 500, the immediate task for buyers today is to overcome the nearest resistance level of $6,819. Overcoming this level would indicate upside and open the path to $6,837. An equally important objective for bulls is to secure control above the $6,854 mark, which would strengthen buyers' positions. In the event of a downside move amid waning risk appetite, buyers must assert themselves around $6,801. A break below this level could quickly push the instrument back to $6,784 and open the way to $6,769.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.