Lihat juga

20.01.2026 08:58 AM

20.01.2026 08:58 AMYesterday, stock indices closed lower. The S&P 500 fell by 0.06%, while the Nasdaq 100 dropped by 0.06%. The Dow Jones Industrial Average plunged by 0.17%.

US Treasuries joined the sell?off in the global bond market, following equity indices, as President Donald Trump's threats to impose tariffs in connection with Greenland renewed trade tensions. The Trump administration's aggressive stance toward the EU is curbing demand for US assets. The biggest losses were borne by longer?dated bonds: the 30?year yield rose by six basis points to 4.90%. Japanese bond yields also deepened their decline, surging to record levels after investors reacted negatively to Prime Minister Sanae Takaichi's pre?election call to cut food taxes.

Futures on US equity indices continued to slide today after Wall Street resumed trading, while European contracts are also under heavy pressure. Asian indices dipped by 0.6%, marking the largest decline in more than a week. As sentiment deteriorated, demand for safe?haven assets jumped sharply, pushing gold and silver to record highs.

Trump's threat to impose tariffs on eight countries opposing his attempt to assert control over Greenland, and Europe's pushback, have reignited volatility and driven investors into precious metals. The return of trade tensions, against the backdrop of concerns about the Federal Reserve's independence and Trump's policies, is further turning investors away from risk assets.

According to Vantage Markets, markets appear to be taking an extremely negative stance on the new tariff?related developments.

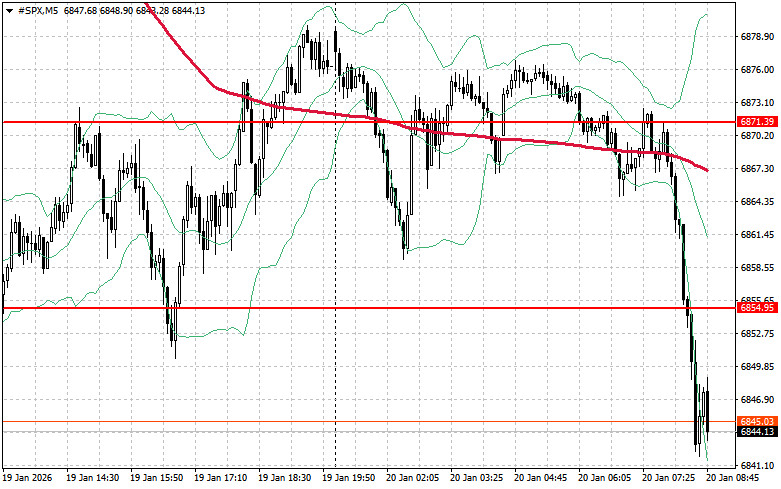

As for the technical outlook for the S&P 500, the main task for buyers today will be to overcome the nearest resistance level of $6,854. Doing so would indicate upside and open the path to a move toward $6,871. An equally important objective for bulls is to secure control above $6,883, which would strengthen buyers' positions. In the event of a downside move amid waning risk appetite, buyers should defend around $6,837. A break below this level could quickly push the instrument back to $6,819 and open the way to $6,801.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.